We stopped our search on March 12, 2022 and I figured I’d write up why we decided to take a pause when so many have decided to plow ahead. And what we’re seeing so far.

1. The Fed is changing direction this year

On Mar 9th, the Fed stopped Quantitative Easing and on Mar 16th, they raised rates a mere .25%. . They had signaled both of these were going to happen, and they indicate a major shift in how the Fed intends to handle the economy this year. At least for a while, they are taking the foot of the gas and placing it, however lightly, on the brakes.

Did I know what this would do to mortgage rates? Or will do to prices? No, but something was about to change, and I figured why not see what the result of this change would be.

Result so far: It’s been a month and a half since we stepped back. So far mortgage rates have soared in response to the Fed’s light tap, in anticipation of their next moves. And it has had a cooling effect on the market. Not yet enough to reduce prices in San Diego, but certainly to lower demand slightly. This can be seen in the increasing inventory, it is low still, but it is building.

In the upcoming week, at the May FOMC meeting, the Fed will communicate the next rate hike is as well as whether QT will begin.

2. It’s impossible to buy prudently

In case you haven’t heard, right now “the only way to compete” in the home buying market is to do the following:

- Get a loan that’s at the very edge of your DTI

- Find a house that’s insanely overpriced, and overbid by several 100,000

- Waive your inspection contingency and take the hit for whatever problems your house ends up having

- Waive your appraisal contingency and be ready to pay up for the gap between what the bank thinks your house costs and what you need to bid to “win”

All of these practices which have become typical today could put a buyer in a very dangerous position. This is one asset in which you are investing a large part of your net worth, and which in turn has a large impact on your quality of life and your available oppportunities in the future.

I don’t want to compete in a market that has become irrationally reckless.

Results so far: Unfortunately “recklessness” is not something that is being tracked by the MLS. So I’ve no idea if it’s become possible to bid with all contingencies yet. Houses are still insanely overpriced so I intend to wait.

3. Increasing rates make my DTI too high

DTI is the debt-to-income ratio. My DTI is by no means near the max of what is required for the loans. But it is above where I would like it to be, especially as rates increase. This makes me anxious, especially since my partner is self-employed and not making a steady income. My steady income could cover our mortgage, but what if there is a recession and I lose my job? I’d feel much safer if we had two incomes, especially since several recession indicators have flashed red since the start of 2022.

Granted, we have enough invested that I could lower the loan using additional downpayment, or have a long emergency runway to cover the mortgage using savings. But even then, that wouldn’t be a good situation to find myself in. So I’d rather not put myself in that position, especially as I mentioned, with the possibility of recession looming larger.

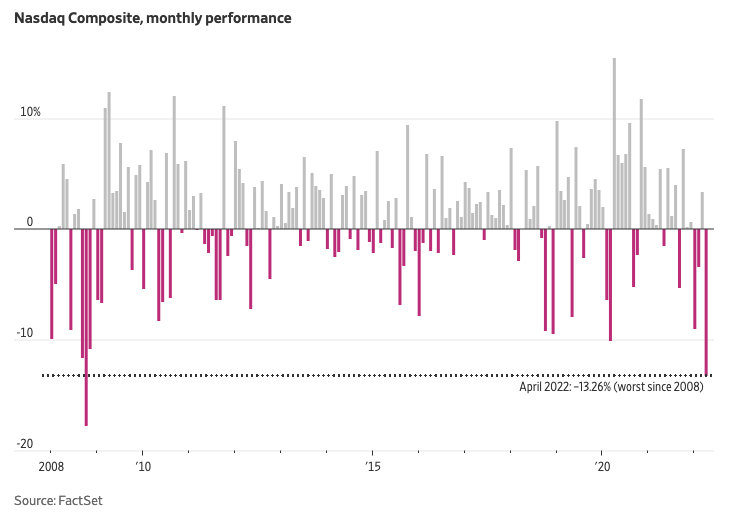

Result so far: The GDP shrank in the April report, one more month and we are officially in recession. Technology stocks have had the worst month on record since 2008. The layoffs haven’t started, but the clouds are forming.

I’m a software engineer, so how tech does directly impacts my job security. Thankfully, my current job is in civic tech working on government projects. These are unlikely to go away as the govt. is woefully slow to slash contracts or change direction. However it’s not impossible.

I did want to find another job, actually. But all the recruiting emails I get are bragging about their VC financing rounds, rather than profitability. I realized I might do well to wait and see which of these startups survive the next year. My partner has started looking for a job.

4. Rental market should soften in San Diego

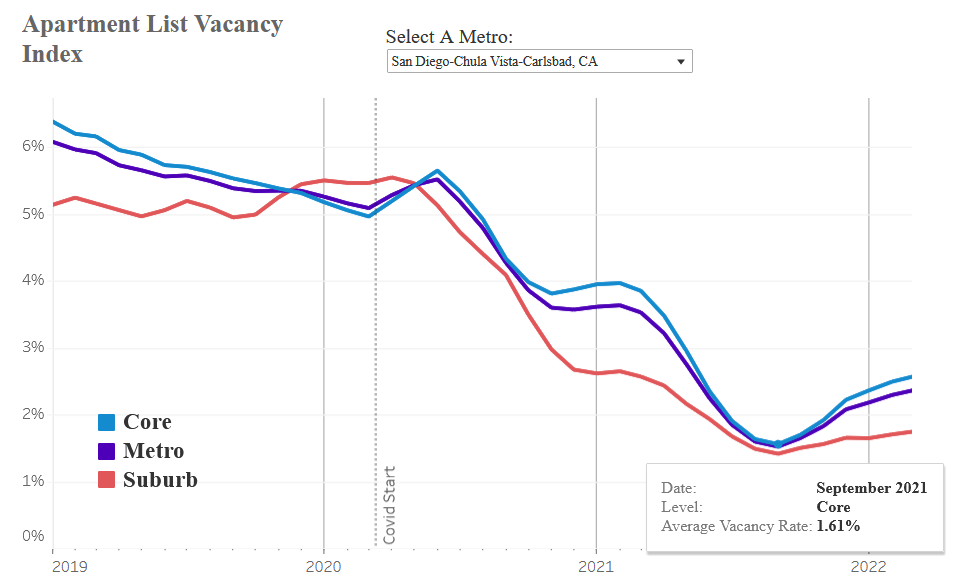

San Diego is a popular location for Airbnb rentals, given it’s tourist destination status. It’s also been a popular destination for other California city expats like those in LA or SF. This has made rental vacancies extremely low at 2%, which led to a huge increase in rents. This of course motivates more investors to buy homes at ever increasing prices, believing they can rent them out at ridiculous prices.

However, for a number of reasons, I believe the rental market should soften this year. And with that, the investors will dump airbnbs and unprofitable rental properties.

Results so far: A marker I am watching is rental vacancies. This is slowly ticking up but still has a ways to go. I expect improvement after October this year.

5. We don’t really need a house

Currently, we don’t actually need a house. We have a great 2 bedroom apartment that’s basically the top floor of a small building. It has a private garage and a deck with a view. It has hardwood floors, 360° windows and amazing light.

We want a house because we hope to travel again soon and not having to deal with landlords is part of the plan. But we don’t need a house. We love where we are and it’s quite affordable compared to what we’d need to pay for a mortgage.

Results so far: We still love our apartment 🙂

Disclaimer: I’m an idiot first time home buyer. I’ve never taken an econ class in my life. I’m just sharing what I see and learn as it happens. I am 100% certain I will get things wrong, so don’t take any of this as the golden truth.